COVID-19 has had a rapid and dramatic impact on almost every business. While a lot has been written about the immediate impact of the virus such as changing media habits, cash needs of businesses, and the migration to a work-from-home culture, not a lot has been written about the long-term impact of the virus. Good marketing is and always will be about being in the right place at the right time for the prospect. How is COVID-19 changing B2B SaaS marketing services and how should SaaS businesses respond now to prepare for the “new normal”?

- Some buyer behavior trends will accelerate

- Marketing plans and budgets need to pivot and be recalibrated quickly

Check out (un)Common Logic’s data-driven approach to digital marketing here.

Read on to learn about three long term digital marketing trends caused or accelerated by COVID-19 and the customer acquisition implications for SaaS companies.

Trend #1: An acceleration of SaaS buyers researching further into the buying funnel before in-person engagement with a sales team.

Almost all of us have heard the Accenture statistic, “Most B2B buyers are already 57% of the way through the buying process before the first meeting with a representative.” Of course, this is an overly broad generalization and varies widely from buyer-to-buyer and industry-to-industry. Regardless, over the past 15 years the B2B buyer’s journey has shifted from in-person interactions towards more online research.

Related to this, there is also an acceleration of B2B product research (including SaaS) to mobile devices. Ten years ago, the author of this post confidently declared, “no one is going to research and buy a $100,000 piece of software on her phone.” Times have changed. In 2019, Google released the statistic, “50% of B2B search queries are made on smartphones.” The Boston Consulting Group goes further by forecasting this number will grow to 70% by the end of 2020.

With the COVID-19 virus and the shift to a work-from-home environment, (un)Common Logic sees a continued acceleration of these trends. While in-person interactions are still vital to the sales process, (un)Common Logic foresees an acceleration of future SaaS customers conducting online research and being further in the sales funnel prior to in-person engagement – regardless of category. Additionally, (un)Common Logic is observing a continued shift to research on mobile devices within our agency customer base, especially for high funnel customers.

Trend #2: A stretching or squeezing of the technology adoption curve

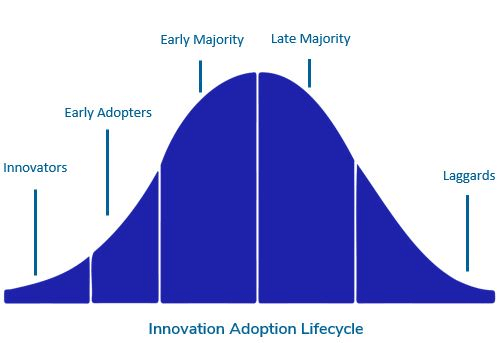

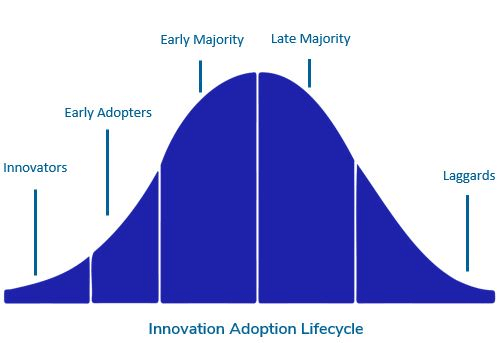

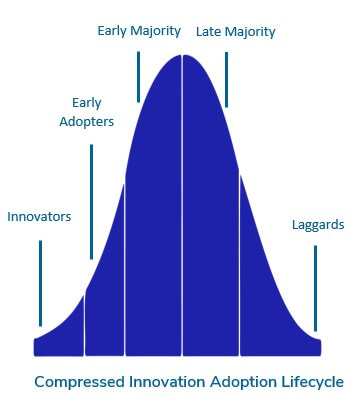

At one time or another, most of us have been exposed to the technology adoption curve. The curve shows the timing of how new technologies are adopted and purchased by the market. It looks like this:

For some products and markets, COVID-19 has compressed and shifted the adoption lifecycle. The most visible example of this is Zoom. Zoom has become part of the vernacular in both the business and consumer world. The product adoption of Zoom, and video conferencing in general, has accelerated. Consumers, schools, and businesses alike who had never tried Zoom prior to COVID-19 (and would be either late adopters or laggards) now rely upon it for daily activities.

Another example is remote working. One of the large retail banks reportedly ordered 50,000 Chromebook laptops for its call center employees to facilitate work-from-home. Prior to COVID-19, the bank had not allowed call center employees to work remotely. Eventually the bank might have tried remote work, but they ended up making the transition within a week.

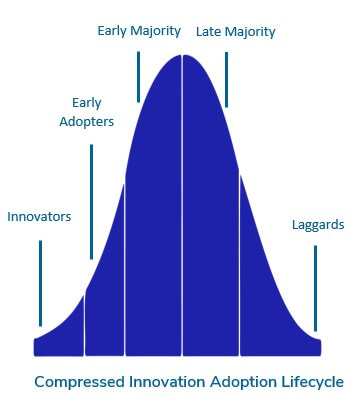

If your SaaS product is deemed “essential,” you have probably seen a similar adoption narrative. While there will be some “return to normal,” many of these new customers and industry norms will continue. In these cases, the technology adoption curve has been compressed from a textbook bell curve to one that looks more like this:

On the other side, some SaaS providers will see a slowing or flattening of the adoption curve. Products that are not deemed as “essential” will see slower adoption as companies are expected to reduce technology and infrastructure budgets post-COVID-19 due to the financial losses caused by the virus.

Trend #3: Decline in in-person conference attendance

At the time this paper is being written, all in-person conferences have either been cancelled outright or delayed to a future date. Additionally, conference hosting organizations are starting to fail. O’Reilly Media, which hosts several large industry conferences, has announced they are shutting down all future in-person events and have laid-off the associated staff.

Once in-person conferences come back online post-cure or vaccine, (un)Common Logic feels that it will take a long time (if ever) for conferences to reach past attendance numbers. The best recent example of this is 9/11. According to the Las Vegas Convention and Visitors Authority, conference attendance was down over 20% in the months following 9/11. It wasn’t until 2005 that hotel occupancy returned to pre-9/11 levels.

COVID-19 is different in that it will have a long tail as opposed to a one-time event, and we expect changes in business practices as well. We feel there will be a reduction in business travel overall as companies rethink potential risks and benefits. Similarly, we believe companies will attend fewer and send fewer people to in-person conferences.

Based on these three trends, we see the following digital marketing implications for SaaS companies and how they can respond:

Consider shifting budget from in-person events to online and other marketing activities.

If in-person events either via a user conference or industry tradeshows are a major line item in your marketing budget, consider reallocating some of the budget to online marketing activities.

While virtual conferences will seek to fill the gap during COVID-19 and beyond, they are not a direct replacement for in-person conferences, especially in the area of networking and new customer acquisition. They can be effective for teaching and learning, but they do not allow the planned or spontaneous networking opportunities provided by an immersive, in-person event.

Instead, consider investing your conference budget into creating and promoting high quality content assets that speak to buyers at all stages of the buying funnel. An example of a company that is doing a good job at this is Accruent ( https://www.accruent.com/resources?type=2). Accruent is creating a wide range of topically relevant content speaking to different buyer types.

If your adoption curve is getting compressed, grab market share now.

If COVID-19 is compressing the technology adoption curve in your market you will have a shorter timeframe in which to establish marketing leadership. As an example, people in business are having “Zoom Coffees” with prospects and not “BlueJeans Coffees.” Several (un)Common Logic clients have seen success using high-funnel targeted display advertising in quickly growing markets to scale acquisition by framing the buying decision and criteria of prospective customers.

The compression of the adoption curve will not only require expanded marketing activities, but also a rethinking of customer onboarding and support functions. As a part of the compression, you need to be ready to onboard less sophisticated customers that will have different support needs than innovators or early adopters.

If your adoption curve is getting lengthened, focus on acquiring and overdelivering to the customers who are in your market. While adoption of your product may have slowed, there will still be customers in your market. Those that are still in-market will either be those who most benefit from your product or are early innovators. Consider adjusting your messaging value propositions to speak to early innovators who may value different attributes than the majority.

It is more important than ever to have a “rock solid” digital marketing infrastructure.

This includes several components:

A robust analytics platform to serve as a “source of truth” and provide the deep insights needed to scale acquisition efforts.

While this sounds elementary, most SaaS companies (un)Common Logic has worked with did not have a solid analytics platform at the beginning of our working relationship. Often SaaS organizations have multiple, conflicting analytics platforms, limited metrics, and customers not properly tracked through the buying process. This prevents the marketing team from gaining the deep insights on how new customers find and interact with you which is essential to scaling digital acquisition.

If your current analytics platform is not as strong as it should be, cleaning and improving it should be the first priority of the marketing organization. If you are unsure as to the quality of your analytics platform, an outside organization can audit the existing platform and offer suggestions for improvement.

High performing desktop and mobile websites that effectively showcase your product.

As more research for your product moves online due to COVID-19, the quality of both your desktop and mobile websites become more important. Companies who win are those whose websites address users throughout the buyers’ journey and effectively showcase the product. Most high performing digital companies (un)Common Logic has seen regularly test and improve their website and user experience using A/B testing or other conversion rate optimization practices.

One specific note: the mobile version of the website continues to grow in importance for SaaS companies. Not only are more searches done on mobile, but Google uses the mobile version of a website to determine organic search ranking. Thus, companies whose mobile site is slow, have technical errors, or are not as deep in content will not see the organic search performance of their peers. Our favorite tool to measure mobile site speed is Google’s PageSpeed Insights (https://developers.google.com/speed/pagespeed/insights/). It not only scores the mobile speed of your website but also gives suggestions on what to do to improve performance.

Regularly add content to your website at all areas of the buying funnel. This is important from both a user experience perspective and as these assets can be promoted via paid media or organic search.

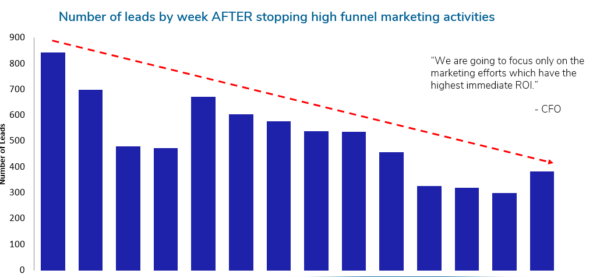

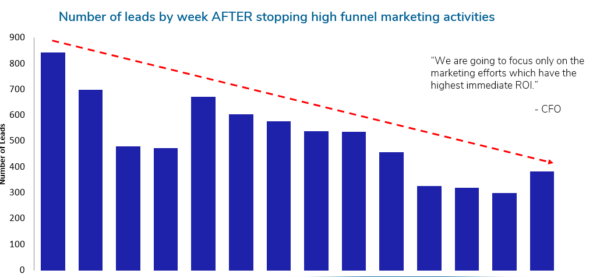

Invest in marketing at all levels of the buying funnel. For SaaS companies, this can be difficult due to the long duration of the customer journey. This is much more difficult in the age of COVID-19 when the pressure is to engage only in low-funnel, high-return activities. However, if you utilize only low-funnel marketing activities, you will not be introducing your brand to new customers and framing the discussion around your product. Instead, your competitors will be framing the discussion.

A little while ago, (un)Common Logic engaged with a prospective client whose marketing qualified leads (MQLs) had dropped by over half over the course of 3 ½ months. After looking at their marketing efforts and company analytics, the (un)Common Logic team determined the decline started soon after the CFO had directed the marketing organization to focus solely on immediate ROI marketing efforts. As soon as the high-funnel activities were turned off, the immediate marketing ROI increased but their MQL volume dropped:

SaaS companies that win play the long game and figure out ways to invest in both low and high funnel traffic.

COVID-19 is changing the marketing and buying landscape for SaaS companies and their customers. Once the virus is controlled, the SaaS world will not go back to “business as usual.” Fundamental structural changes are coming which can be a threat and an opportunity. Those that can adjust to the changes will thrive.

Contact us if you want to talk about how these trends may apply to your marketing efforts or about our paid media services.

COVID-19 has had a rapid and dramatic impact on almost every business. While a lot has been written about the immediate impact of the virus such as changing media habits, cash needs of businesses, and the migration to a work-from-home culture, not a lot has been written about the long-term impact of the virus. Good marketing is and always will be about being in the right place at the right time for the prospect. How is COVID-19 changing B2B SaaS marketing services and how should SaaS businesses respond now to prepare for the “new normal”?

- Some buyer behavior trends will accelerate

- Marketing plans and budgets need to pivot and be recalibrated quickly

Check out (un)Common Logic’s data-driven approach to digital marketing here.

Read on to learn about three long term digital marketing trends caused or accelerated by COVID-19 and the customer acquisition implications for SaaS companies.

Trend #1: An acceleration of SaaS buyers researching further into the buying funnel before in-person engagement with a sales team.

Almost all of us have heard the Accenture statistic, “Most B2B buyers are already 57% of the way through the buying process before the first meeting with a representative.” Of course, this is an overly broad generalization and varies widely from buyer-to-buyer and industry-to-industry. Regardless, over the past 15 years the B2B buyer’s journey has shifted from in-person interactions towards more online research.

Related to this, there is also an acceleration of B2B product research (including SaaS) to mobile devices. Ten years ago, the author of this post confidently declared, “no one is going to research and buy a $100,000 piece of software on her phone.” Times have changed. In 2019, Google released the statistic, “50% of B2B search queries are made on smartphones.” The Boston Consulting Group goes further by forecasting this number will grow to 70% by the end of 2020.

With the COVID-19 virus and the shift to a work-from-home environment, (un)Common Logic sees a continued acceleration of these trends. While in-person interactions are still vital to the sales process, (un)Common Logic foresees an acceleration of future SaaS customers conducting online research and being further in the sales funnel prior to in-person engagement – regardless of category. Additionally, (un)Common Logic is observing a continued shift to research on mobile devices within our agency customer base, especially for high funnel customers.

Trend #2: A stretching or squeezing of the technology adoption curve

At one time or another, most of us have been exposed to the technology adoption curve. The curve shows the timing of how new technologies are adopted and purchased by the market. It looks like this:

For some products and markets, COVID-19 has compressed and shifted the adoption lifecycle. The most visible example of this is Zoom. Zoom has become part of the vernacular in both the business and consumer world. The product adoption of Zoom, and video conferencing in general, has accelerated. Consumers, schools, and businesses alike who had never tried Zoom prior to COVID-19 (and would be either late adopters or laggards) now rely upon it for daily activities.

Another example is remote working. One of the large retail banks reportedly ordered 50,000 Chromebook laptops for its call center employees to facilitate work-from-home. Prior to COVID-19, the bank had not allowed call center employees to work remotely. Eventually the bank might have tried remote work, but they ended up making the transition within a week.

If your SaaS product is deemed “essential,” you have probably seen a similar adoption narrative. While there will be some “return to normal,” many of these new customers and industry norms will continue. In these cases, the technology adoption curve has been compressed from a textbook bell curve to one that looks more like this:

On the other side, some SaaS providers will see a slowing or flattening of the adoption curve. Products that are not deemed as “essential” will see slower adoption as companies are expected to reduce technology and infrastructure budgets post-COVID-19 due to the financial losses caused by the virus.

Trend #3: Decline in in-person conference attendance

At the time this paper is being written, all in-person conferences have either been cancelled outright or delayed to a future date. Additionally, conference hosting organizations are starting to fail. O’Reilly Media, which hosts several large industry conferences, has announced they are shutting down all future in-person events and have laid-off the associated staff.

Once in-person conferences come back online post-cure or vaccine, (un)Common Logic feels that it will take a long time (if ever) for conferences to reach past attendance numbers. The best recent example of this is 9/11. According to the Las Vegas Convention and Visitors Authority, conference attendance was down over 20% in the months following 9/11. It wasn’t until 2005 that hotel occupancy returned to pre-9/11 levels.

COVID-19 is different in that it will have a long tail as opposed to a one-time event, and we expect changes in business practices as well. We feel there will be a reduction in business travel overall as companies rethink potential risks and benefits. Similarly, we believe companies will attend fewer and send fewer people to in-person conferences.

Based on these three trends, we see the following digital marketing implications for SaaS companies and how they can respond:

Consider shifting budget from in-person events to online and other marketing activities.

If in-person events either via a user conference or industry tradeshows are a major line item in your marketing budget, consider reallocating some of the budget to online marketing activities.

While virtual conferences will seek to fill the gap during COVID-19 and beyond, they are not a direct replacement for in-person conferences, especially in the area of networking and new customer acquisition. They can be effective for teaching and learning, but they do not allow the planned or spontaneous networking opportunities provided by an immersive, in-person event.

Instead, consider investing your conference budget into creating and promoting high quality content assets that speak to buyers at all stages of the buying funnel. An example of a company that is doing a good job at this is Accruent ( https://www.accruent.com/resources?type=2). Accruent is creating a wide range of topically relevant content speaking to different buyer types.

If your adoption curve is getting compressed, grab market share now.

If COVID-19 is compressing the technology adoption curve in your market you will have a shorter timeframe in which to establish marketing leadership. As an example, people in business are having “Zoom Coffees” with prospects and not “BlueJeans Coffees.” Several (un)Common Logic clients have seen success using high-funnel targeted display advertising in quickly growing markets to scale acquisition by framing the buying decision and criteria of prospective customers.

The compression of the adoption curve will not only require expanded marketing activities, but also a rethinking of customer onboarding and support functions. As a part of the compression, you need to be ready to onboard less sophisticated customers that will have different support needs than innovators or early adopters.

If your adoption curve is getting lengthened, focus on acquiring and overdelivering to the customers who are in your market. While adoption of your product may have slowed, there will still be customers in your market. Those that are still in-market will either be those who most benefit from your product or are early innovators. Consider adjusting your messaging value propositions to speak to early innovators who may value different attributes than the majority.

It is more important than ever to have a “rock solid” digital marketing infrastructure.

This includes several components:

A robust analytics platform to serve as a “source of truth” and provide the deep insights needed to scale acquisition efforts.

While this sounds elementary, most SaaS companies (un)Common Logic has worked with did not have a solid analytics platform at the beginning of our working relationship. Often SaaS organizations have multiple, conflicting analytics platforms, limited metrics, and customers not properly tracked through the buying process. This prevents the marketing team from gaining the deep insights on how new customers find and interact with you which is essential to scaling digital acquisition.

If your current analytics platform is not as strong as it should be, cleaning and improving it should be the first priority of the marketing organization. If you are unsure as to the quality of your analytics platform, an outside organization can audit the existing platform and offer suggestions for improvement.

High performing desktop and mobile websites that effectively showcase your product.

As more research for your product moves online due to COVID-19, the quality of both your desktop and mobile websites become more important. Companies who win are those whose websites address users throughout the buyers’ journey and effectively showcase the product. Most high performing digital companies (un)Common Logic has seen regularly test and improve their website and user experience using A/B testing or other conversion rate optimization practices.

One specific note: the mobile version of the website continues to grow in importance for SaaS companies. Not only are more searches done on mobile, but Google uses the mobile version of a website to determine organic search ranking. Thus, companies whose mobile site is slow, have technical errors, or are not as deep in content will not see the organic search performance of their peers. Our favorite tool to measure mobile site speed is Google’s PageSpeed Insights (https://developers.google.com/speed/pagespeed/insights/). It not only scores the mobile speed of your website but also gives suggestions on what to do to improve performance.

Regularly add content to your website at all areas of the buying funnel. This is important from both a user experience perspective and as these assets can be promoted via paid media or organic search.

Invest in marketing at all levels of the buying funnel. For SaaS companies, this can be difficult due to the long duration of the customer journey. This is much more difficult in the age of COVID-19 when the pressure is to engage only in low-funnel, high-return activities. However, if you utilize only low-funnel marketing activities, you will not be introducing your brand to new customers and framing the discussion around your product. Instead, your competitors will be framing the discussion.

A little while ago, (un)Common Logic engaged with a prospective client whose marketing qualified leads (MQLs) had dropped by over half over the course of 3 ½ months. After looking at their marketing efforts and company analytics, the (un)Common Logic team determined the decline started soon after the CFO had directed the marketing organization to focus solely on immediate ROI marketing efforts. As soon as the high-funnel activities were turned off, the immediate marketing ROI increased but their MQL volume dropped:

SaaS companies that win play the long game and figure out ways to invest in both low and high funnel traffic.

COVID-19 is changing the marketing and buying landscape for SaaS companies and their customers. Once the virus is controlled, the SaaS world will not go back to “business as usual.” Fundamental structural changes are coming which can be a threat and an opportunity. Those that can adjust to the changes will thrive.

Contact us if you want to talk about how these trends may apply to your marketing efforts or about our paid media services.